What is a crypto legal opinion and why does your project need one?

In the ever-evolving landscape of cryptocurrencies and blockchain technology, it is crucial for crypto projects to ensure compliance with legal frameworks. Recently, obtaining a legal opinion for your crypto project is more important than ever before.

Having spent the best part of 3 years working directly with crypto projects, including a bunch of tokens and projects derived from ICOs/IDOs, I’ve found it startling the lack of knowledge that a lot of teams have when it comes to a crypto legal opinion.

They’re an absolutely essential part of an effective compliance toolkit, and not having one could leave you exposed if a regulator (such as the SEC), ever comes knocking.

Let’s be clear. A legal opinion won’t make you immune from any form of indictment, but it at least shows you’ve taken steps (before raising capital) to gauge that what you’re doing is legal, and you aren’t embarking on what could be seen as an unregistered securities offering.

This blog post will explore the significance of legal opinions in the crypto industry, highlighting their benefits and discussing the potential repercussions of not having one. Furthermore, we will delve into notable events from crypto history where legal opinions played a pivotal role, such as the SEC vs Ripple Labs case.

Let’s dive in.

Understanding the Role of Legal Opinions for Crypto Projects: What is a Crypto Legal Opinion?

A legal opinion is a professional assessment provided by a legal expert or a team of lawyers. It offers an authoritative analysis of the legal implications and risks associated with a specific project or initiative. In the context of crypto projects, a legal opinion evaluates compliance with relevant regulations and provides guidance on potential legal hurdles.

Ultimately, it should provide some form of legal clarity (in the perspective of the lawyer who writes it), as to the likelihood of your asset being found to be a security.

Why does this make a difference? Well, as a matter of fact, it makes a huge difference.

The Howey Test

Security is an asset that hits all four prongs of the Howey Test. The most synonymous assets associated with being securities are stocks and equities. Here is an overview as to what Howey is, and the four prongs that determine if an asset is a security.

If all four prongs are hit, then your asset could be deemed a security, and must be registered with relevant regulators, and disclosures must be made to investors. On the flip side, if even one of the prongs isn’t met, then it’s unlikely that the underlying asset will be found to be a security.

Historical Significance of Howey

The Howey test was established by the United States Supreme Court in 1946 in the case of SEC v. W.J. Howey Co. The test was used to determine whether transactions qualified as investment contracts and, therefore, if they fell under the securities laws and regulations.

The historical significance of the Howey test lies in its establishment of a legal framework to identify securities offerings beyond traditional stocks and bonds. Prior to this case, the definition of security was relatively narrow and did not encompass certain investment schemes.

The Howey case involved the W.J. Howey Company, which offered parcels of land in Florida with citrus groves to investors. The company claimed that these land sales were not securities and therefore not subject to federal securities regulations. However, the Supreme Court ruled differently and developed the Howey test to determine whether an investment contract existed.

From there onwards, Howey has been used to assess financial assets up to the present day. There is scepticism within the crypto industry as to the relevance of Howey, as it was never initially created to assess digital assets. Nevertheless, the SEC remain staunch advocates of Howey, and unless Congress intervenes, Howey will be used to ascertain if rules have been broken, or disclosures haven’t been provided to investors.

Here are some other key reasons why your crypto project should consider obtaining a legal opinion:

- Regulatory Compliance: The crypto industry operates within a complex regulatory environment. Laws regarding securities, anti-money laundering (AML), know-your-customer (KYC), taxation, and data protection can vary across jurisdictions. A legal opinion helps you navigate these intricate regulatory frameworks, ensuring your project remains compliant and minimizing the risk of legal complications.

- Investor Confidence: Having a legal opinion can instil trust and confidence in potential investors. It demonstrates your commitment to transparency, legality, and regulatory compliance, which are crucial factors that investors consider before allocating capital. With a legal opinion in hand, you can showcase that your project has undergone thorough legal scrutiny, increasing the likelihood of attracting investors.

Risk Mitigation: The crypto industry is not immune to legal challenges and disputes. By obtaining a legal opinion, you can proactively identify and address potential legal risks associated with your project. This helps you implement effective risk management strategies, thereby minimizing the possibility of legal disputes, financial losses, and reputational damage.

Notable Events Highlighting the Importance of Legal Opinions

There have been a number of recent events in the crypto-sphere that underscore the necessity of possessing a legal opinion in the first instance.

- SEC vs Ripple Labs: The ongoing legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs showcases the significance of legal opinions in the crypto space. The SEC alleges that Ripple's XRP token is a security, while Ripple argues that it should be classified as a currency/commodity.

- The fact that Ripple sought a legal opinion early in the stages of XRP’s development has been a crucial part of their fair notice defense.

- ICO Regulation: In recent years, Initial Coin Offerings (ICOs) faced increased scrutiny from regulators worldwide. Several projects that failed to comply with securities laws and other regulations faced severe legal consequences. Legal opinions can help ICO projects navigate these challenges, assess whether their token offerings fall within the scope of securities regulations, and take appropriate measures to comply with relevant laws.

The Benefits of Having a Legal Opinion

There are other benefits to having a legal opinion, outside of the regulatory/enforcement argument.

- Clarity and Guidance: A legal opinion provides valuable clarity on the legal aspects of your crypto project. It helps you understand the legal implications of your business model, token issuance, fundraising mechanisms, and compliance requirements. With this guidance, you can make informed decisions and structure your project in a way that aligns with legal requirements.

- Investor Protection: Investors are increasingly cautious about investing in crypto projects due to the prevalence of scams and fraudulent activities. By obtaining a legal opinion, you demonstrate your commitment to investor protection and regulatory compliance. This can attract potential investors who prioritize projects with a solid legal foundation and reduce the risk of facing legal actions from disgruntled investors in the future.

- Competitive Advantage: In an industry as competitive as crypto, standing out from the crowd is crucial. By having a legal opinion, you differentiate your project by showcasing its legitimacy and compliance. This can enhance your project's reputation, gain a competitive edge, and open doors to strategic partnerships and collaborations.

The Potential Repercussions of Not Having a Legal Opinion

The ramifications of not obtaining a legal opinion can be severe.

- Regulatory Violations: Operating without a legal opinion increases the likelihood of inadvertently violating applicable laws and regulations. Regulatory bodies can impose substantial penalties, fines, or even pursue criminal charges against non-compliant projects. By neglecting a legal opinion, you expose your project to unnecessary risks and legal liabilities.

- Investor Skepticism: In the absence of a legal opinion, investors may question the legality and compliance of your project. This scepticism can deter potential investors, limit fundraising opportunities, and hinder the growth and success of your crypto project.

- Legal Disputes: Without a legal opinion, your project might face a tough time combatting legal disputes, such as regulatory investigations, lawsuits, or enforcement actions. These legal battles can be financially draining, time-consuming, and damaging to your project's reputation. Additionally, they can divert focus and resources from your core business objectives.

- Exchanges may not list your token: A lot of cryptocurrency exchanges are increasing levels of due diligence when listing assets on their respective platforms. A legal opinion is oftentimes required prior to listing on a reputable exchange.

Does Your Project Need A Legal Opinion? - Yes!

As has (I hope) been made abundantly clear by now, a legal opinion is fundamentally important to your crypto project. Just to be sure, let’s break it down one more time.

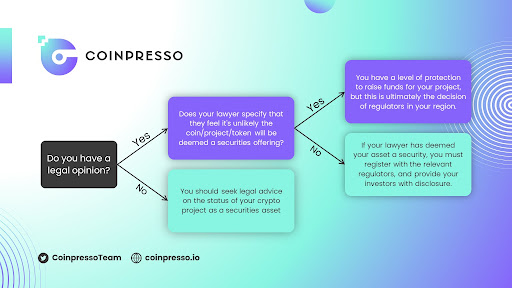

This basic flowchart outlines the steps you should be taking in line with your legal opinion. It’s important to note that I’m not a lawyer, and you should always seek legal counsel that pertains to your own needs and circumstances.

Conclusion

In the dynamic landscape of cryptocurrencies and blockchain technology, obtaining a legal opinion for your crypto project is essential. It helps ensure regulatory compliance, builds investor confidence, mitigates legal risks, and provides a competitive advantage. By examining historical events like the SEC vs Ripple Labs case, we understand the significance of legal opinions in the crypto industry.

Neglecting a legal opinion can lead to regulatory violations, investor scepticism, and legal disputes, potentially derailing your project's success. Therefore, it is crucial for crypto projects to prioritize legal due diligence and seek professional legal opinions to thrive in the evolving crypto ecosystem.

If you’re utilizing crypto marketing strategies and spending capital on taking your project to market, best to be sure that what you’re doing is compliant.

On that note, if you or your project need support with your marketing objectives, contact Coinpresso today for a free strategy session.

For a legal opinion, you should seek an experienced crypto lawyer in your region, and regions you are looking to target.