Unit 1, Voting Behaviour, 1st year of college.

My teacher, James, welcomes me into his classroom with his usual line of questioning regarding my ‘extracurricular’ activities.

“Not sure what you’re on about, sir” I retorted through the grimace that you only get from a 16 year-old that thinks they’ve got the world sussed, and their fecal matter doesn’t stink.

Actually, I owe James a lot.

He made writing, debate, and generally being an economic-super-Chad ‘cool’. Had it not been for him, and his persistent desire to keep me on the straight-and-narrow through a pretty tough childhood, I’d be nowhere near where I am today.

Alas, it’s the teachings that I learnt in his A-Level Government & Politics class that has shaped the way we do business, and particularly, how I personally measure token-based economies.

One lesson in particular has been repeatedly going through my head of late, like a monkey clashing cymbals in my degenerate brain. I guess that’s the sign of a good teacher?

The 1992 Presidential Election Campaign

Cast your mind back to Bill Clinton’s successful campaign of 1992 vs. the incumbent George Bush.

Yes, I know I wasn’t alive then, but stay with me here.

In what was touted as one of the key points of rhetoric amidst a backdrop of a then-prevailing recession, his strategic advisor, James Carville, famously quipped a line which became synonymous with the Clinton campaign.

Carville even went to the lengths of hanging a note on Clinton’s Little Rock headquarters, to ensure that this messaging became the standard.

- Change, vs. more of the same.

- The economy, stupid.

- Don’t forget healthcare.

Obviously, this is largely Democrat campaign spin (or propaganda, whichever you prefer) designed to hit incredibly general pain points, without even having to offer a proper fiscal plan as to how they’d go about it.

But, it worked.

Americans had grown disenfranchised with Bush, reflected by a tumultuous swing in his approval ratings, from 91% satisfied post ground war in Kuwait, slumping to 64% disapproval of his job performance just one year later. Clinton, Carver et al, took full advantage.

The economy had become a massive issue for the American public and largely influenced voting behavior.

I Don’t Care About Your Utility, If The Numbers Are Bilge

Why have I spent the last few minutes recounting entry-level college classes?

Well, the same issue that affected voting behavior in this example, has a lot of crossover within the world of Web3 tokenomics.

Recently, we made an incredibly tough decision to cancel a client, after new information came about regarding what I’d refer to as a lack of transparency and integrity on their token economy.

It’s absolutely astounding as to the amount of projects that have come across our desk that have not properly stress-tested their tokenomic models, blissfully unaware (or ignorant) of the fact that they have set their own project up for failure by way of poor tokenomic balance.

I could care less about your “super-AI-GPT-passive-income-play-to-earn” fadcoin if your numbers are absolute nonsense, as is the same with any other serious investor outside of the degens and plebs gambling on BNBChain, BASE and the like.

Want people to take you seriously, then you should be modeling your economy based on an extreme bear market scenario. Unfortunately, very few do.

Let’s have a look at some of the biggest red flags that exist within token-based economies, and how you can go about identifying them.

Unlocked Liquidity Pools (LP)

This one really grinds my gears.

When a token goes live on a Decentralized Exchange (DEX), such as PancakeSwap, typically the founding team/developer will add liquidity to the smart contract or protocol. Obviously, without any actual money backing the token, it's just lines of computer code such as Solidity or Rust.

A pairing is set up in order to facilitate the movement of funds within the token ecosystem.

USDT/USDC in, project native token out, and vice versa. Without sufficient liquidity in the contract, or enough depth on the order book of exchanges, the token is susceptible to huge volatility and price impact with each buy & sell.

So first things first, make sure there’s enough proper money, not just our beloved magic internet money.

Liquidity added, what next?

Any decent founding team (or human being for that matter) will then make a commitment to investors by locking this LP. This means that, for a certain amount of time, it is physically impossible for a founding team or project member to access the liquidity pool. It’s sensical that if you’ve raised a bunch of money from the public, you should be making some form of contractual commitment not to be able to take cookies from the jar whenever you see fit.

This is the absolute basics of decency, not being able to steal from investors that have helped to fund your project, and immutably proving so via a lock period.

Sadly, this isn’t always the case.

Let’s look at this unnamed project. I’ve blanked out the name as, although what I say is an undeniable fact, I’m not going to FUD an ex-client.

The warning here is stark and obvious. An unlocked project wallet has access to the USDC within this liquidity pool, at any given time. With a few clicks, the project devs could perform a rugpull on all actual funds within the project - leaving investors “holding the bag” and their tokens made worthless in an instant.

Besides the notion of decency which I’ve already mentioned, this sort of issue within a token economy also has further ramifications on the future prospects of said token and its ability to access different markets.

No top tier exchange such as Binance, ByBit or the likes, will ever list a token on their platform when these optics are in play. Nobody wants to promote a scam project, so even if you feel you have the most innovative, unique reason as to why you should be able to access investor funds at any time - this doesn’t wash with any credible player in this space.

Sure, you can list on DEXs, or mega low-rent Centralized Exchanges (CEXs) but you won’t ever get backing from the big guys. The growth of the project is kneecapped at the start, due to the narrowmindedness of the project team.

It’s unacceptable.

Poor Supply Side Tokenomics

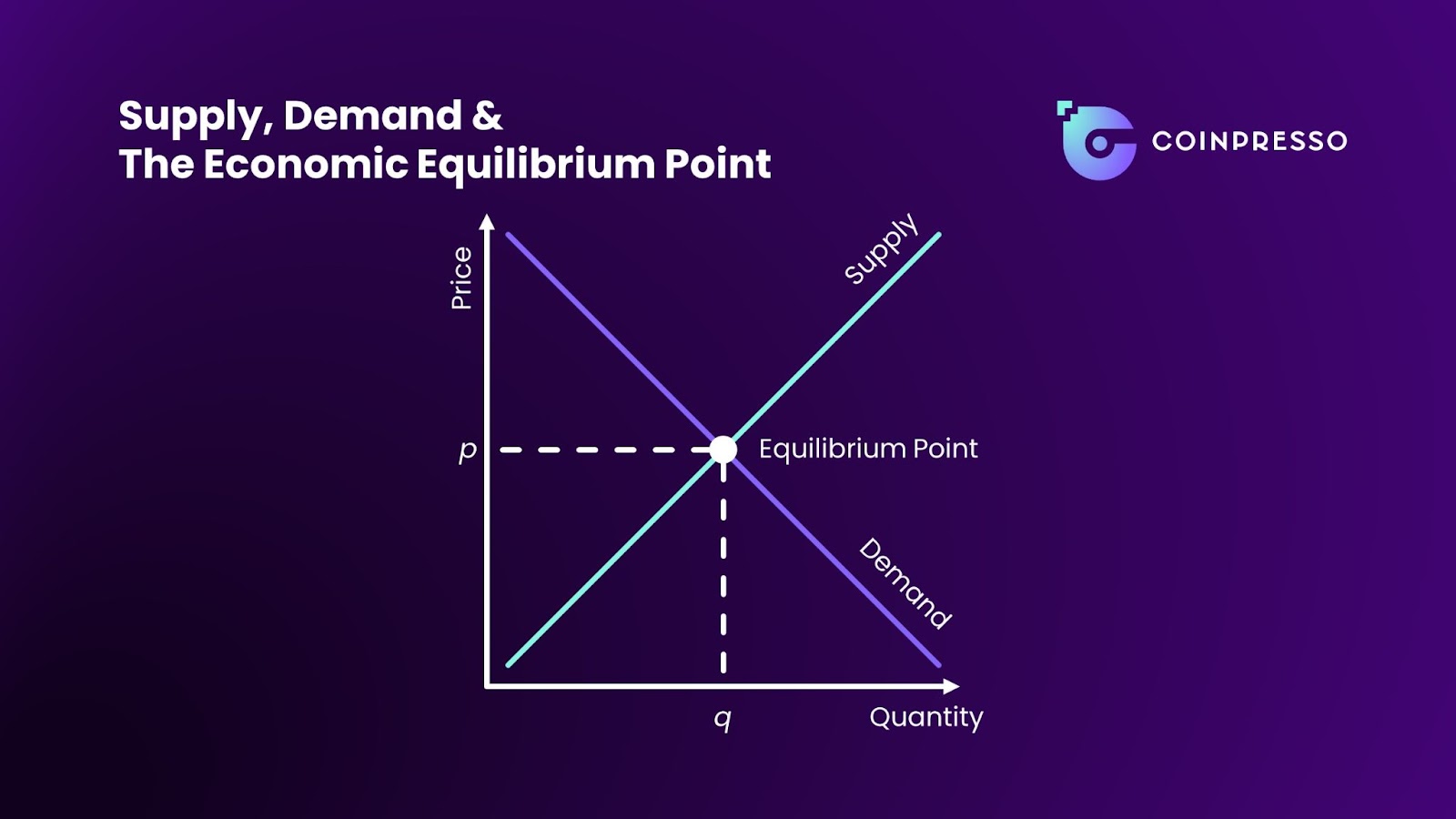

This comes more under incompetence rather than outright shadiness. Supply & demand is, in essence, Economics lesson 1. Here’s the S&D chart for reference:

Generally speaking, central banks look to find the Equilibrium Point, a place of fiscal ‘Valhalla’ where supply and demand are at perfect levels, helping to maintain healthy prices and inherent, stable value in a currency.

Too much supply, like we have seen as a result of excessive Quantitative Easing (QE) of both the USD & GBP over the last 10-15 years, has seen the actual value of our dollars and pounds drop considerably. The purchasing power of the U.S. dollar dropped by around 7% during 2022 and 2023 alone.

Sure, there are other economic factors at play, like war & inflation, but generally speaking, too much supply of something reduces its intrinsic value.

For some reason however, some token founders seem to think that the basic laws of economics do not apply to them.

As alluded to earlier, we recently became aware of a severe lack of transparency with an ex-client. Specifically speaking, a large amount of tokens accumulated by the team themselves (yikes) that were hidden on another blockchain. These tokens could be bridged at any time to the main decentralized market on PancakeSwap, raising major issues in regards to the ability of the founding team to flood the market with the token, and crash the price.

“But we won’t do that, we promise!”

Will leave it to you to decide as to how much this all stinks. Promises mean 0 within crypto, unless you’re immutably proving said promises via cryptographic ledgers. Hiding coins on other chains, that are purely owned by founding teams, represents horrendous optics, and is something we can never ever associate with as a company.

Having a healthy supply, met by efficient demand, is fundamental to the success of any crypto project. You could be working with the best crypto marketing agency in the world, but if the numbers aren’t right, you’ll come unstuck.

Every, single, time.

Lack Of Effective Vesting Schedule

Greed. It’s the only reason.

The Ethereum ICO, way back in 2014, was what became the ‘gold standard’ of vesting schedules. The token sale itself, and the formation of the Genesis Block, took place on the Bitcoin blockchain. Commitments in BTC were taken by the Ethereum Foundation, championed by Ethereum Founder Vitalik Buterin and his Consensys cronies. To keep this simple, they took $BTC, in exchange for $ETH, the native currency of the soon-to-be-incepted Ethereum blockchain.

More than 7 million Ether, around $2.2M USD at the time, was sold in just 12 hours. The ICO went on to sell out in full, and the success of Ethereum since is one of the shining jewels within the crown of cryptocurrency. This ultimately paved the way for the ICO boom that followed.

However, you can’t just chuck all these tokens out on the open market on Day 1. Mass profit taking would ensue due to lack of checks and balances on investor ability to sell tokens. If you’re presented with a quick 5x on launch, you’re probably gonna take it, right?

Well, this is one of the many things the Ethereum Foundation got right. They implemented a smart contract-fulfilled (automated) vesting schedule, whereby investors in the ICO were drip-fed tokens monthly, over a period spanning 4 years. This massively limits sell pressure, and is a sign of proper token modeling in an extreme bear scenario.

“What would happen if every investor sold their tokens at point A, B, C?”

This is the question that the Ethereum Foundation evidently were asking themselves and thus, baked-in to the ICO exactly how the tokens would be distributed, and over what cadence.

The $ETH ICO was held at a price of around $0.30 per Ether, and now sits at $2,780 at the time of writing. “You don’t get that down the Bradford & Bingley!” - as Derek Trotter would say.

The importance of vesting is abundantly clear, yet why do new founders seem to think they are immune from basic economic principles? Well, our unnamed ex-client also seemed to think that these rules didn’t apply to them.

They initially added around $300k in liquidity to PancakeSwap, at a token listing price of $0.01. Native tokens were of course added to complete the pairing, 30M tokens to be exact. All is ok here.

However, the secret chain I mentioned earlier, happened to have 94M tokens, owned by the founding team (double yikes) that they were not prepared to vest under any circumstance. The ignorance here is mind boggling.

The tokens the team possesses, and are able to dump on investors due to lack of vesting, were over 3x the value of the liquidity (actual money) within the contract.

“But we won’t dump, we promise!”

Yet, I’m apparently the crazy one?

Refer to previous answer. Your promises mean NOTHING. Get a Gnosis Safe, vesting wallets, and encode your promises into the blockchain. Anything less is an erosion of the core fundamentals of blockchain technology.

Issuing Tokens Within Strict Regulatory Regions, Without Regulatory Approval

This comes from either a lack of knowledge, or a blatant disregard of the knowledge.

A common myth within the Web3 vertical is that if a project is decentralized enough, you don’t need to register with a regulatory authority when issuing tokens out of regulated regions. This is completely and utterly false.

I would need more than two hands to count the number of times that a project has set up an LLC or LTD company out of Delaware in the U.S. or London within the UK. This is possibly one of the dumbest things you can do.

To understand why, let’s look at a few of the most prominent regulators across regions:

The SEC, FCA, and ESMA are “cop on the beat” within their respective jurisdictions.

When raising money from the public within these regions, a variety of disclosures and investor protections are required in order to help sustain healthy capital markets. By registering your crypto token within these regions, means you MUST follow regulatory guidelines as laid out by the respective regulator.

The FCA doesn’t give a toss if your ChadAI coin is decentralized.

If you’re taking money from the public, or British passport holders, you have to register. There is no cheat code in these regions, and I bet good money that your project will be sued for offering unregistered cryptoasset securities, especially if it becomes popular. The price will tank overnight (XRP circa 2020, for example) and you’ll be lumbered with a hefty fine, anywhere between $15M and $1B.

You should engage with a licensed legal professional within the Web3 sphere before ever setting up companies in jurisdictions in which you don’t fully understand the securities laws. Or, seek advice from said professional as to what countries are friendlier towards crypto assets at the regulatory level.

“It’s Not Backed By Anything”

Back to my politics teacher, despite being an incredibly astute dude, still maintains that crypto isn’t “backed by anything”.

I mean, in the instance of scam projects like the unnamed example, he’s absolutely right.

If the actual money doesn’t cover 100% sell pressure of the magic internet money, then the token economy is imbalanced, stupid! Banks are allowed to operate fractionalized models, but crypto token founders cannot ‘play God’ in this instance.

Yet it still continues to astound me the number that do.

If you are serious about your project, and want to talk to serial Web3 professionals about your token economy, then contact Coinpresso today.

Dedicated to James Hamilton.

Disclaimer: The content within this blog, and any other Coinpresso.io content, should not be construed or taken as financial advice. You should always consult a licensed Financial Advisor regarding any of the aforementioned issues in this, or any other Coinpresso LLC content.