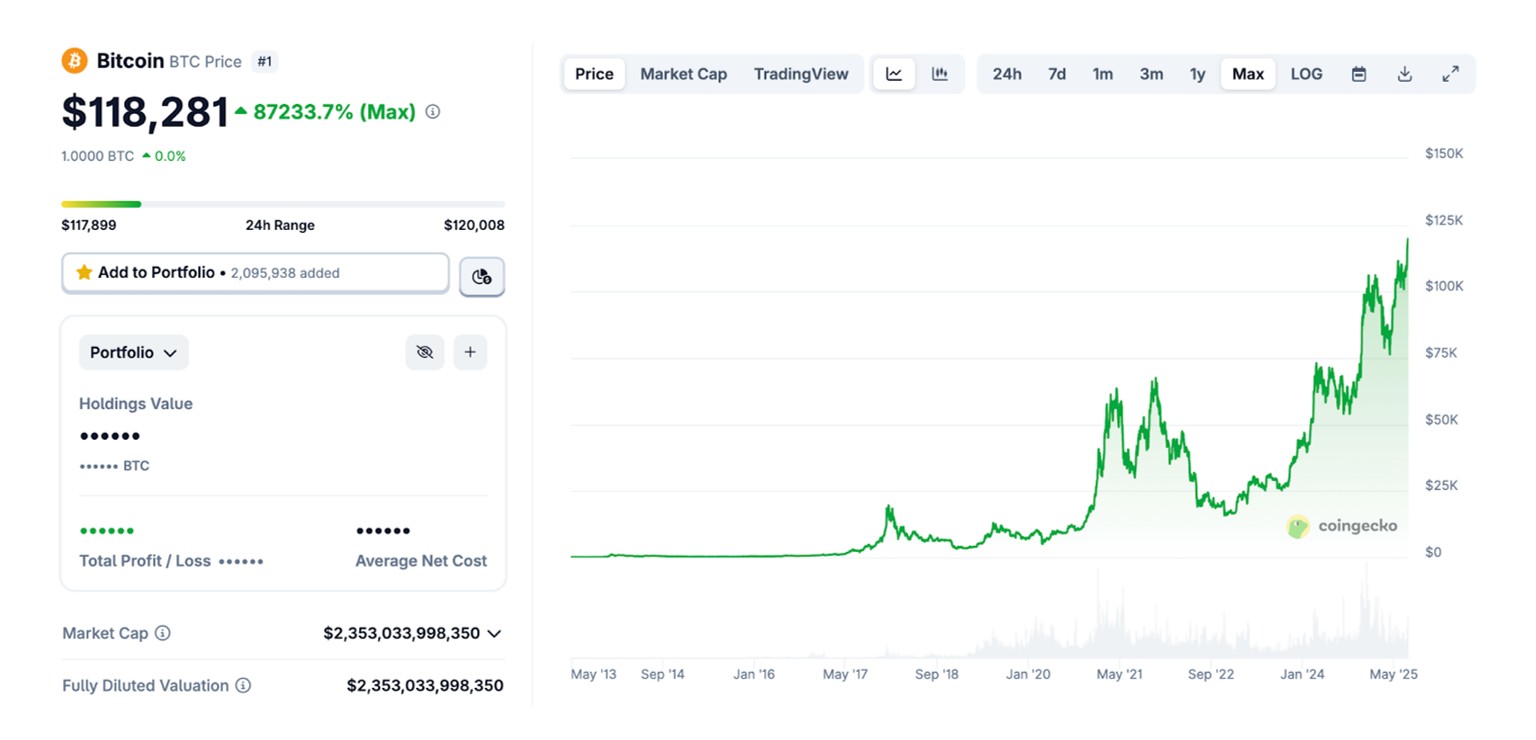

This Bitcoin bull run has arguably been the most dramatic since Satoshi's whitepaper was published over a decade ago. Bitcoin's price has surged repeatedly to new all-time highs, breaking above $100,000 for the first time in late 2024 before hitting the $120,000 barrier in July 2025.

The momentum behind Bitcoin is being driven by numerous factors, including the increasingly supportive regulatory environment in the United States and Europe, accumulation by major institutions, including governments and the likes of BlackRock and Fidelity, and growing adoption among investors who were previously skeptical of crypto.

The surge in investment has pushed the broader cryptocurrency market's capitalization to just $4 trillion and made Bitcoin more valuable in terms of market capitalization than Amazon and Google.

The headline is positive, of that there is no doubt. However, the immense success of Bitcoin does present challenges for the broader market for new projects. As Bitcoin's market dominance eclipses 60%, altcoin projects are vying for an increasingly restricted amount of liquidity.

Fortunately, previous cycles suggest that these types of Bitcoin bull runs are followed by altcoin cycles, which means that projects leveraging effective crypto marketing strategies today could stand to benefit tomorrow once a rotation out of Bitcoin occurs.

Adapting Crypto Marketing to Market Cycles

The Bitcoin bear market reached its bottom in 2022. Following several black swan events such as the FTX debacle and the Luna stablecoin shambles, momentum reached a critical low point. Bitcoin had seen its price crash from $69,000 to under $20,000 in a matter of months. Headlines claiming that "crypto is dead" dominated the space, and for anyone working in Web3, they were extremely tough times.

Fortunately, the clouds began to clear in 2023. Bitcoin's price steadily increased from its low of $16,000, and by the end of 2023, it was trading well above $45,000. Although momentum had improved, BTC had still underperformed the broader financial markets. No one at this point expected Bitcoin's market capitalization to flip the likes of Amazon or Alphabet.

It was in 2024 that the cycle began to heat up, and a long-term bullish trend was confirmed by technical analysts and commentators. Towards the end of the year, Bitcoin started to shift into new all-time high territory and surged to $100,000 as the year came to a close.

In 2025, the bullish momentum has continued. BTC is now trading well above $110,000, and its market capitalization has come within touching distance of $2.5 trillion. But what does this mean for developers working on memecoins, DeFi protocols, NFT collections, and layer-2 solutions?

What Makes Crypto Marketing Strategy for Bull Market Different

The Bitcoin bull market means that huge amounts of capital are flooding into the cryptocurrency market. However, a lot of this capital is moving into Bitcoin ETFs or being held on the balance sheets of corporations accumulating BTC. However, it still presents a massive opportunity for developers in the space, even if they aren't directly operating with Bitcoin.

Bull runs attract a diverse audience, mixing seasoned traders, FOMO-driven retail investors, and increasing institutional interest. This diversification means that marketing must adapt to cater to new groups, from those new to crypto concepts to sophisticated institutional players. Messaging needs to be clear, concise, and tailored to varying levels of knowledge.

Bull markets are characterized by surging trading volumes, heightened FOMO, and often positive regulatory news or ETF tailwinds. Marketing needs to capitalize on rapid shifts in sentiment and price. Campaigns must be ready to scale quickly to meet surging demand and convert immediate interest into sustained engagement.

These requirements can be met through the implementation of a comprehensive crypto marketing strategy. Such a strategy integrates various tools and approaches to effectively reach and convert the diverse audience present in a bullish market, ensuring that projects can truly capitalize on the increased market liquidity and attention.

Marketing Techniques for Capturing Volume During Bull Runs

How to market crypto during a bull run depends on the project at hand when looking at specifics. However, there are some marketing tools that are almost always useful and have their place in a marketing plan when trying to grow a user base and trading volume in the midst of a Bitcoin bull run.

Content & SEO Strategy for Bullrun

During bull runs, content strategy needs to pivot quickly. New investors flood the market with beginner questions like “how to buy crypto” and “what is DeFi.” Projects that create clear, actionable educational content will be positioned to capture this fresh demand. Think simple explainers, step-by-step guides, and FAQs that lead readers toward signup or token purchase.

Beyond content creation, crypto SEO optimization becomes critical. Teams should focus on identifying high-volume, trending keywords related to both Bitcoin and altcoin surges. Blog content, landing pages, and even homepage copy should be updated to align with these terms. Long-tail phrases such as “best crypto to buy during bull run” or “DeFi platforms 2025” can drive valuable, conversion-ready traffic.

Importantly, content must blend relevance with speed. Timing is everything during a bull market. Projects that publish answers before the competition often capture the lion’s share of attention.

Programmatic Advertising for Bullish Cycles

Programmatic advertising is essential for scaling visibility during a crypto bull run. These campaigns can be launched fast, using automated systems that place ads across thousands of websites and apps, targeting investors when they’re actively looking to engage. With market activity spiking, programmatic ads help projects capitalize on short windows of opportunity.

Typically, expert ad teams handle setup, choosing between display, video, and native formats while leveraging advanced targeting methods like behavioral profiles and lookalike audiences. Campaigns are optimized based on real-time data: impressions, click-through rates, conversions. Dedicated teams continuously refine audiences and creatives as the market evolves.

Early-stage projects can start small, then scale budgets rapidly once positive signals emerge. Combined with retargeting, programmatic ads keep your project visible to high-intent users looking to profit from the bull run without buying Bitcoin near all-time highs.

Parasite SEO Services for Bullish Cycles

Parasite SEO services for crypto offer an aggressive shortcut to visibility during bull markets. This strategy involves publishing content on high-authority external platforms that already rank well on Google. Instead of waiting for your own website to rank, parasite SEO lets projects piggyback on established domain authority to appear in top search results almost instantly.

Targeting bull run narratives is key. Articles or sponsored content titled “Top 5 Crypto Projects to Watch This Bull Run” or “Bitcoin Price Prediction for 2026” attract organic search traffic from curious new investors. Each piece should link strategically to your official site or landing pages, channeling that attention toward your platform.

Professional SEO services often manage parasite campaigns, identifying trending keywords, writing optimized content, and placing it across multiple authority sites.

The Power Of Crypto Marketing During Bullish Bitcoin Cycles

This bull run has been extraordinary. Bitcoin has pushed the overall market capitalization of all cryptocurrencies to nearly $4 trillion. Crypto is no longer some sort of wild west niche – it’s a domain within the global financial market. Developers building in the space now have the opportunity to capture the millions of new users and investors piling into crypto, but to do so, they must understand how to get their projects noticed.

Expert crypto marketing agencies support new projects with comprehensive marketing strategies that leverage tools like programmatic ads, parasite SEO services, and crypto SEO to bring users initially drawn to Bitcoin further into the broader crypto economy.

FAQs

What defines a crypto bull run?

A crypto bull run is a sustained period of significant and widespread price increases across the cryptocurrency market. It's characterized by strong optimism, surging trading volumes, and increased investor confidence, often leading to a buying frenzy and new all-time highs.

How long do these bull runs typically last?

The duration of crypto bull runs is unpredictable, but historically, they can last from a few months to about a year. Past cycles show intense periods of rapid growth, often followed by corrections. Some theories link them to Bitcoin halving events, suggesting approximate four-year cycles.

What common marketing traps should businesses avoid?

Businesses should avoid overhyping without substance, making "guaranteed returns" promises, and ignoring regulatory compliance. Other pitfalls include relying on fake engagement metrics, neglecting community management, and running "one-and-done" campaigns without follow-up, which can erode trust.

What is the best crypto marketing strategy for a bull market?

The best strategy for a bull market is to be agile and data-driven. Focus on rapidly scaling programmatic ads for broad reach and targeted conversions. Leverage PR and thought leadership for credibility, and adapt content to educate new market entrants while optimizing for trending keywords.

How do we generate quality leads during a run?

Generate quality leads by focusing on educational content that converts curiosity into action for new investors. Utilize advanced programmatic targeting to reach high-intent users. Capitalize on FOMO with clear calls-to-action, and ensure fast, conversion-optimized landing pages. Implement retargeting campaigns for warm leads.