Crypto pre-sales have become a popular way for projects to raise funds and for early investors to snap up tokens at possibly discounted rates. In 2024 alone, several pre-sales, such as $TUK and $DOGVERSE, have raised millions of dollars. But how important is a crypto pre-sale? And how can you identify pre-sales with potential?

This comprehensive guide is your roadmap to navigating the world of crypto pre-sales. We'll cover everything from the basics of what a pre-sale entails to in-depth strategies for evaluating projects and making informed investment decisions. Adding these strategies to your research tool kit will help you identify projects that solely rely on crypto marketing from those that offer genuine value.

Understanding Crypto Pre-Sales

A crypto pre-sale is an event in which a project offers a limited number of its tokens or coins to early supporters, usually at a discounted price. These pre-sales typically occur before the token's official public launch, and they serve several key purposes.

While pre-sales, Initial Coin Offerings (ICOs), and Initial DEX Offerings (IDOs) all involve selling tokens to raise funds, there are key differences:

- Pre-Sales: Often smaller in scale, targeting a select group of investors or community members. They focus on initial funding and community building before a wider launch.

- ICOs: Larger public sales of tokens, typically conducted on the project's own platform. ICOs were the predominant fundraising method in the early days of crypto but have become less common due to regulatory concerns.

- IDOs: Similar to ICOs but conducted on decentralized exchanges (DEXs). IDOs offer greater accessibility and a more streamlined process compared to standard ICOs.

Why Do Projects Conduct Pre-Sales?

Crypto pre-sales are more than just a fundraising mechanism. They play a crucial strategic role in a project's early lifecycle, offering multiple benefits beyond simply securing capital.

Firstly, pre-sales allow projects to gauge market interest and validate their idea before a full-scale launch. By offering tokens at a discounted price, projects can attract early adopters and assess the level of demand for their product or service. This valuable feedback can help refine their offering and ensure a successful public launch.

Furthermore, pre-sales play a crucial role in community building. By giving early supporters exclusive access to tokens and project updates, projects can foster a sense of ownership and loyalty among their community. This dedicated community can become a powerful advocate for the project, driving organic growth and adoption.

Finally, pre-sales are a crucial stepping stone towards a successful public listing on exchanges. By generating initial liquidity and demonstrating market demand, projects can position themselves for favorable listing terms and attract a wider investor base.

While there’s potential for high returns, there are also plenty of risks when it comes to crypto pre-sales.

How to Evaluate a Crypto Pre-Sale

A thorough evaluation of a pre-sale is crucial before committing any funds. This process, often referred to as "due diligence," helps you assess the project's potential and mitigate risks. Several key areas warrant careful scrutiny.

- Team and Advisors

A strong team with relevant experience is a major indicator of a project's potential for success. Research the backgrounds of the core team members and advisors. Look for experience in blockchain development, business, or finance. Reputable projects often have publicly available team profiles on their website or LinkedIn. Be especially cautious around non-doxxed projects (anonymous teams).

- Project Whitepaper

A well-crafted whitepaper is a comprehensive document outlining the project's vision, goals, and technical details. Pay close attention to the problem statement, proposed solution, tokenomics, and roadmap. A transparent and detailed whitepaper can help you assess the project's feasibility and potential impact.

- Community and Social Presence

An active and engaged community is a positive sign for any crypto project. Explore the project's social media channels, such as Telegram, Discord, Twitter, and Reddit. Look for open communication, transparency from the team, and a vibrant community of supporters. Projects with social media channels managed by professional Web3 social media marketing stand a better chance of building successful online communities.

- Partnerships and Collaborations

Strategic partnerships can provide credibility and resources to a project. Verify any partnerships mentioned by the project. Look for announcements or mentions on both parties' websites or social media channels.

- Technology and Innovation

Evaluate the technological foundation of the project. Does the project offer a unique solution or a significant improvement over existing technologies? Understand the project's use case and assess its potential to disrupt or enhance the market.

You can better understand the pre-sale opportunity and make more informed investment decisions by thoroughly evaluating these factors.

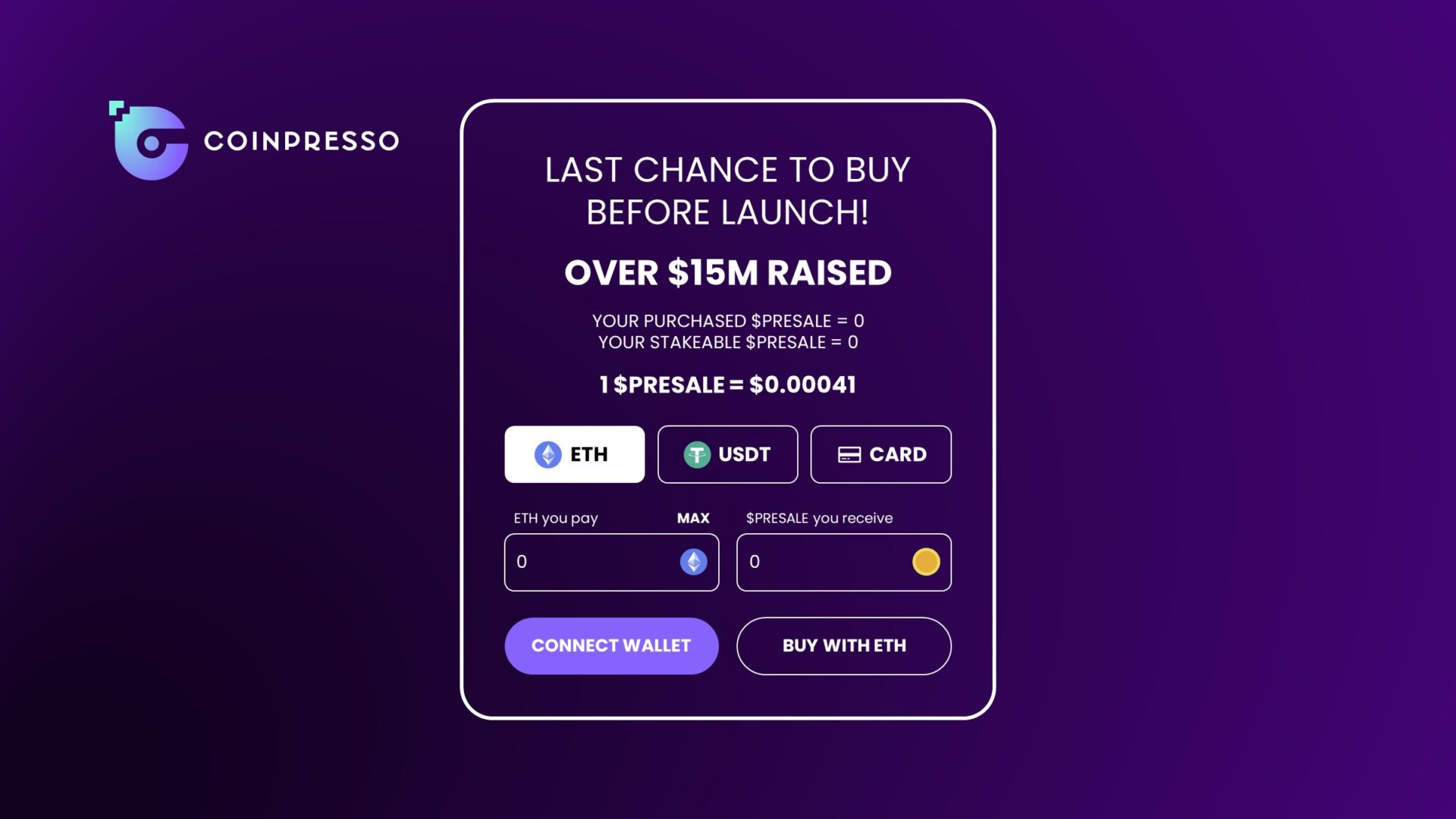

How to Participate in a Crypto Pre-Sale

To participate in a pre-sale, you'll need a compatible crypto wallet. Choose a secure wallet that supports the blockchain network on which the pre-sale is conducted (e.g., Ethereum, Binance Smart Chain). Popular options include MetaMask, Trust Wallet, and Ledger hardware wallets.

Follow the wallet provider's instructions to set up your wallet and create a strong password. Securely store your seed phrase in a safe location, as this is the key to accessing your funds.

Securing Funds

Purchase the cryptocurrency required for the pre-sale from a reputable exchange. Transfer the funds to your wallet, ensuring you double-check the correct wallet address before confirming the transaction.

To enhance security, consider enabling two-factor authentication (2FA) on your wallet and exchange accounts. Additionally, avoid sharing sensitive information or clicking on suspicious links.

Registering for the Pre-Sale

Most pre-sales require registration or participation in a whitelist. Visit the project's official website or social media channels for instructions on how to register. You may need to complete a Know Your Customer (KYC) process to verify your identity.

Making the Purchase

During the pre-sale period, follow the instructions provided by the project to purchase tokens. This typically involves sending the required amount of cryptocurrency to a designated wallet address. Be sure to confirm the details carefully before sending any funds.

After the pre-sale, actively track the performance of your investment. Utilize tools like CoinMarketCap or CoinGecko to monitor token price movements and overall market trends. Regularly review your portfolio and adjust your holdings based on your risk tolerance and investment goals.

Case Study: Ethereum's ICO Groundbreaking ICO

Ethereum's 2014 initial coin offering (ICO)raised a substantial $18.3 million in Bitcoin, and it also laid the groundwork for the development of the world's second-largest blockchain platform.

The Ethereum ICO was a pre-sale that offered early supporters the opportunity to purchase Ether (ETH), the platform's native token, at a rate of 2,000 ETH per 1 BTC, which at the time was equivalent to less than $1 per $ETH. Today, ETH trades for around $3,000, meaning anyone who participated in the pre-sale and held on to their tokens has been rewarded with astounding profits.

Beyond financial gains, Ethereum's ICO achieved several crucial milestones that contributed to its long-term success. It generated essential funding for the development of the Ethereum network, allowing the team to build a robust platform for decentralized applications (dApps). The pre-sale also produced a passionate and dedicated community of early adopters who became staunch advocates for the project.

Since the Ethereum pre-sale, the value of ETH has surged. Source: TradingView

Final Thoughts on Crypto Pre-Sales

Crypto pre-sales offer a unique opportunity to support projects in their early stages and potentially earn significant returns on your investment. However, the market is fraught with risk, from volatile market fluctuations to regulatory hurdles and the ever-present threat of scams.

Thorough research is non-negotiable. Dive deep into the project's team, whitepaper, and community to ensure it aligns with your investment goals and risk tolerance. A comprehensive understanding of the project's technology, tokenomics, and roadmap is crucial before committing funds.

Remember, not all pre-sales will yield the desired results. Stay vigilant, maintain realistic expectations, and only invest what you can afford to lose.