Decentralized finance (DeFi) has shown that it truly can be a proper alternative to traditional centralized finance due to its massive surge in adoption this year. In 2025, the total value locked across all DeFi dApps has been nothing short of astonishing, with billions of dollars flowing in from retail and institutional investors. dApps have become easier to use, safer, and more diverse thanks to this influx of interest.

A large part of the puzzle when building a successful DeFi dApp and token is providing a secure, accessible, and reliable platform for yield. At the end of the day, yield is what most users are chasing, but they are also very loyal to their preferred platforms, and it takes considerable marketing to convince them to shift their capital.

A DeFi marketing agency can help a platform elevate its place in the industry and carve out a bigger chunk of total value locked. These agencies provide all the tools a team needs to get their dApp noticed and build a loyal community.

DeFi in 2025: Adoption Surges along with TVL

DeFi has been around for several years now. The idea of decentralized finance was born out of the Ethereum project, which made it possible to create dApps using smart contracts. These dApps were simple at first, but have since grown into complex platforms where users can earn yield by lending out their coins and even take out loans.

In 2025, DeFi has hit its stride. Adoption has surged among both retail users and institutions. Major financial institutions have entered the space, millions of new users have joined the ecosystem, and even leading politicians and regulators are opening up to the idea of decentralized finance.

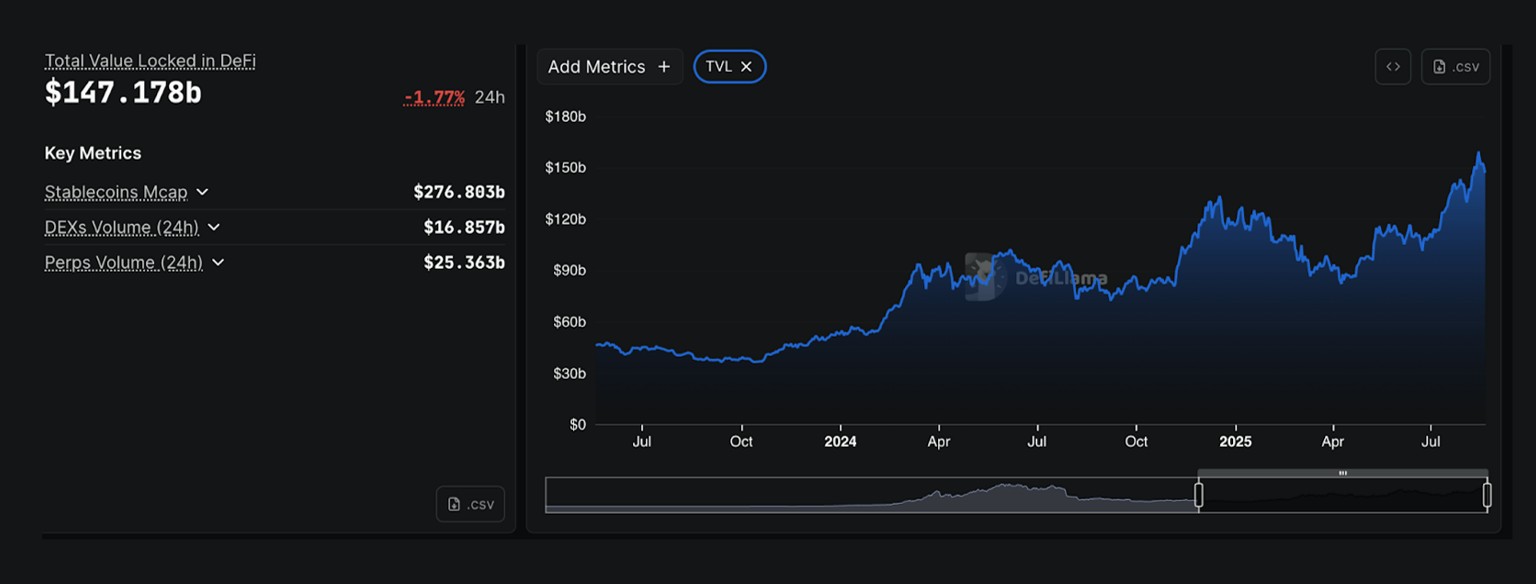

One of the most important metrics for measuring the health of DeFi is the Total Value Locked (TVL). TVL represents the total amount of digital assets deposited across protocols, including lending platforms, decentralized exchanges, and liquidity pools. A higher TVL signals stronger user trust and higher levels of activity in the ecosystem.

TVL has been recovering steadily since the 2022 crash and is now nearing all-time highs. According to DeFiLlama, over $145 billion in value is currently locked across all chains. Layer-2 networks such as Base and Arbitrum have been especially successful in 2025, capturing significant inflows of capital.

A large portion of this TVL is locked directly in DeFi-related smart contracts, underscoring how central decentralized finance has become to the wider crypto economy.

Finding the Right DeFi Marketing Agency for Your Project

DeFi projects are some of the most complex dApps in the crypto industry. Many of these platforms offer very niche use cases, such as flash loans or high-yield returns for liquidity provision. It’s crucial for teams to partner with a DeFi marketing agency that has the tools and expertise to communicate the dApp’s narrative effectively.

Crypto SEO for DeFi

For DeFi projects aiming to build a long-term position in the market, crypto SEO is the ideal marketing technique. Although SEO can be time-consuming, when done right, it can seriously pay off by driving highly relevant streams of traffic directly to a dApp’s website.

Crypto SEO refers to the process of optimizing a project’s online presence so that search engines rank it higher for specific crypto-related keywords. For DeFi, this means visibility for searches that directly connect users to lending, borrowing, or yield opportunities, ultimately translating into more adoption.

Implementing crypto SEO usually begins with a full site audit, keyword research, and identifying high-value terms. From there, teams work on technical improvements such as site speed, mobile optimization, and link-building, paired with high-quality content targeting DeFi-focused searches.

Specialized agencies can also help DeFi projects compete for highly competitive keywords while uncovering opportunities with decent volume but lower ranking difficulty, giving new platforms a chance to break into search results faster.

A strong example of crypto SEO in action is Aave. The lending and borrowing platform ranks on the first page of Google for competitive, high-volume DeFi keywords such as “DeFi lending platform”, making it easier for new users to discover and trust the protocol.

Programmatic Ads for DeFi

Programmatic ads are ideal for DeFi platforms looking to promote their native tokens. This form of digital advertising leverages data-driven technology to identify and target users who are most likely to be receptive to specific niches such as DeFi platforms and tokens.

When run through an experienced agency, programmatic campaigns are set up with compelling ad copy, eye-catching graphics, and engaging visuals designed to capture attention. The goal is to communicate the value of the platform quickly while standing out in a crowded digital environment.

Agencies then deploy the campaigns across selected ad networks and continuously monitor performance. They compile detailed reports on clicks, impressions, conversions, and other key inputs such as tokens purchased or app downloads. This data-driven feedback loop allows for constant optimization, ensuring ad spend delivers the best possible return for the DeFi project.

Press Release Creation and Distribution for DeFi

Crypto press release distribution is a vital tool for building a DeFi project’s authority. The advantage of this approach is that it can be used to target both the Web3 community and the traditional financial world, provided the PR team has access to editors across a broad range of outlets.

Expert crypto copywriting teams can craft press releases that highlight clarity, the project’s value proposition, and credibility. These elements are essential for standing out in a crowded market and for instilling trust in both retail investors and institutions.

DeFi projects should collaborate with a crypto marketing agency that offers strong distribution channels. These agencies typically have connections with leading crypto media outlets, mainstream financial publications, and established PR wires.

Final Thoughts on DeFi Marketing in 2025

As DeFi adoption and TVL grow, new opportunities are emerging for teams building dApps and innovative solutions. However, the market is fiercely competitive with major players now deeply involved. Only the best dApps can succeed in capturing a share of this multibillion-dollar industry, and even the most ethically sound projects will require DeFi marketing support if they are to grow into true market leaders.

FAQs

What is DeFi marketing?

DeFi marketing refers to specialized strategies used to promote decentralized finance platforms, tokens, and dApps. It involves techniques like SEO, programmatic ads, PR distribution, and community building to increase visibility, attract users, and build trust in an increasingly competitive Web3 landscape.

How is the DeFi market performing in 2025?

In 2025, the DeFi market is experiencing strong growth, with Total Value Locked (TVL) nearing all-time highs above $145 billion. Adoption has surged among retail and institutional investors, supported by easier-to-use dApps, Layer-2 expansion, and increasing mainstream recognition of decentralized finance solutions.

What are DeFi tokens?

DeFi tokens are digital assets tied to decentralized finance protocols. They often serve as governance tokens, staking assets, or liquidity incentives. Holders may use them to vote on proposals, earn yield, or access platform features, making them integral to the functionality of DeFi ecosystems.